New E-Methanol Project and Bunkering Hub in Oman: What It Means for Investors and the Maritime Industry

MUSCAT, NOV 6 — HIF Global, a leading international producer of carbon-neutral e-fuels, is spearheading a consortium of global and local partners to explore the development of an e-methanol production facility alongside a bunkering hub in Salalah, southern Oman.

In a significant first step, the consortium signed a Memorandum of Understanding (MoU) this week with Oman’s Ministry of Transport, Communications and Information Technology in Spain, coinciding with the state visit of His Majesty Sultan Haitham bin Tarik to the country.

The consortium includes Acciona Nordex Green Hydrogen, known for delivering large-scale green hydrogen and e-fuel projects powered by renewable wind and solar energy. This partnership combines Acciona’s infrastructure and renewable energy expertise with Nordex’s wind technology to produce sustainable, low-carbon fuels for global markets. Local Omani firm Al Meera Investments is also a key partner in the initiative.

HIF Global highlighted the MoU, stating, “The agreement establishes a public-private partnership to explore developing a large-scale e-methanol production and bunkering hub in Dhofar, Oman, supporting the decarbonization of the global shipping industry. Together, we take another step toward a cleaner world powered by e-fuels. Let’s keep pushing the energy transition forward.”

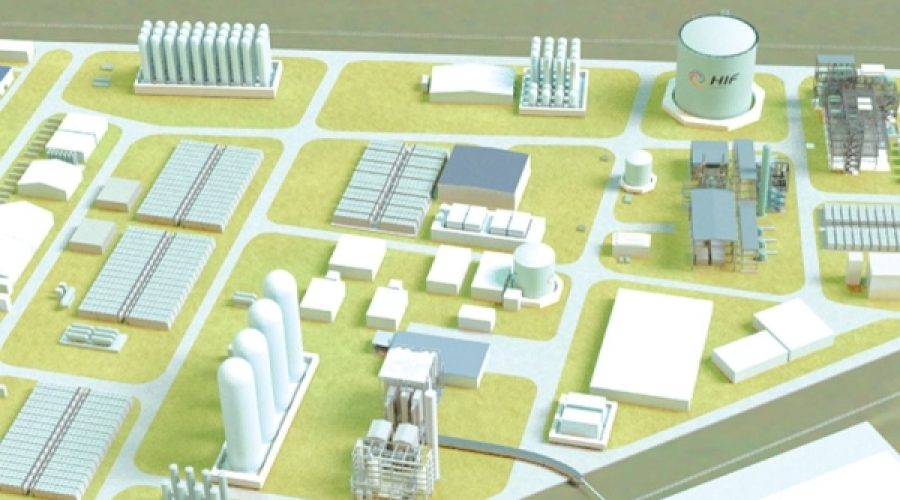

Headquartered in Houston, USA, HIF Global is recognized for scaling synthetic fuel production from green hydrogen and captured carbon dioxide. With operational projects in Chile, the United States, Australia, and Uruguay, HIF converts renewable electricity into hydrogen through electrolysis and combines it with CO₂ to produce e-methanol. This e-methanol can be further refined into e-gasoline, e-diesel, or sustainable aviation fuel. Supported by investors such as Porsche and Baker Hughes, HIF aims to decarbonize transport and aviation sectors by providing low-carbon, drop-in fuels compatible with existing engines and infrastructure.

Under the MoU, the consortium and the Ministry will collaborate to evaluate the technical, regulatory, and commercial opportunities to develop a large-scale e-methanol project leveraging Oman’s abundant renewable energy resources and coastal infrastructure. The consortium will conduct feasibility and techno-economic studies to assess the potential for e-methanol production, bunkering, and export in Dhofar Governorate. This includes integrating wind and solar power for green hydrogen generation, capturing CO₂ from industrial and biogenic sources, and converting it into e-methanol. The Ministry will coordinate regulatory alignment, land allocation, and potential incentive frameworks with relevant Omani authorities.

This e-methanol initiative is the latest strategic effort to establish Salalah as a regional hub for low-carbon fuels catering primarily to the maritime shipping sector.

In December 2022, OQ Alternative Energy (OQAE), part of Oman’s OQ energy group, signed a Memorandum of Cooperation with Asyad Group, A.P. Moller-Maersk, and Sumitomo Corporation Middle East FZE to study the feasibility of green-fuel bunkering operations at Omani ports, particularly Duqm and Salalah. They are exploring the viability of e-ammonia and/or e-methanol bunkering operations for domestic use and export.

More recently, the Port of Salalah entered a strategic lease agreement with Horizon Energy Salalah, a local firm, to create a biofuel storage hub, enhancing Oman’s renewable energy logistics infrastructure.

Special Analysis by Omanet | Navigate Oman’s Market

Oman’s collaboration with global players like HIF Global and Acciona Nordex signals a strategic move to become a regional leader in low-carbon fuel production and maritime decarbonization, leveraging its abundant renewable energy resources. This presents immense opportunities for local businesses and investors to engage in cutting-edge clean energy infrastructure and green fuel export markets, while also positioning Oman as a key hub in the global energy transition. Smart investors and entrepreneurs should now focus on innovative partnerships and regulatory alignment to capitalize on emerging green fuel and bunkering industries.