Bank Muscat Launches Instant Personal Loans via Mobile App: What This Means for Borrowers and Business Growth in Oman

Muscat: Bank Muscat, a leading private bank in Oman, has launched an instant personal loan service through its mobile banking app, enabling customers to apply for financing without visiting a branch or submitting physical documents.

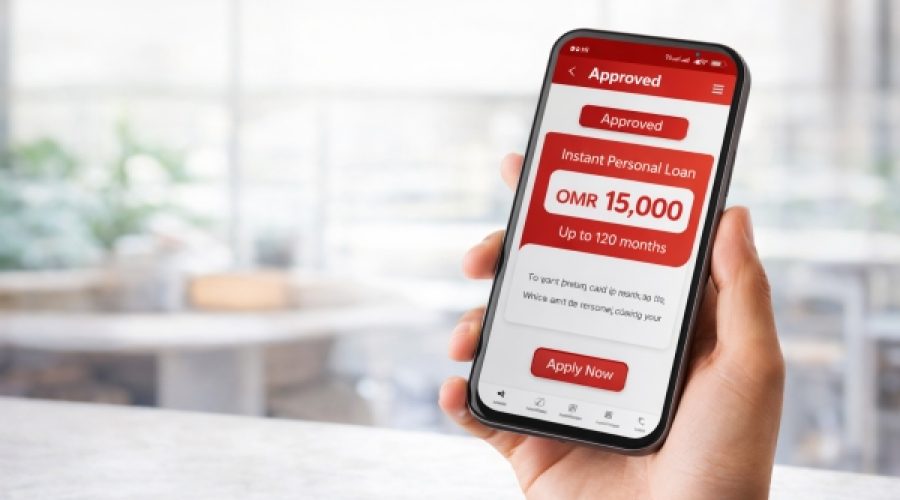

This digital facility allows eligible customers to secure personal loans up to OMR 15,000, with repayment terms extending up to 120 months. Designed for speed and convenience, the entire application process can be completed within minutes, with approved funds credited directly to the customer’s bank account.

The service features instant eligibility verification and loan approval, facilitated by a one-time password confirmation for a streamlined submission process. In partnership with GIG Gulf Insurance, a credit life insurance policy is included with the loan. Customers can view detailed financing information and repayment schedules within the app, and all relevant documents generated during the application are sent to the registered email address.

The instant personal loan is available exclusively to Omani nationals employed by ministries and government agencies. Applicants must be aged between 18 and 60 years and have a minimum monthly salary of OMR 250, which should have been consistently transferred to Bank Muscat for at least the past three months.

Special Analysis by Omanet | Navigate Oman’s Market

Bank Muscat’s launch of an instant personal loan via mobile app marks a significant step toward digital financial inclusion and convenience in Oman. This innovation presents new opportunities for businesses to tap into a broader customer base with faster loan approvals, while investors should watch for growth in fintech-driven credit products. Entrepreneurs may explore complementary digital services that leverage this streamlined lending, anticipating increased consumer spending and financial activity.