Surge in Oman’s Non-Hydrocarbon Revenues: Key Opportunities for Investors and Entrepreneurs

MUSCAT, JAN 5 – Non-hydrocarbon revenues in Oman—comprising taxes, levies, fees, and other income sources—are showing a continued upward trend. This growth reflects the government’s ongoing efforts to decrease reliance on hydrocarbon revenue.

The increase is particularly evident in anticipated collections from Value Added Tax (VAT) and excise taxes, which are projected to reach RO 735 million in 2026, marking an 8% rise from the RO 680 million estimated for 2025. Similarly, corporate income tax revenues are set to rise to RO 684 million, a 4.3% increase from the RO 656 million projected for 2025.

Additionally, dividends amounting to RO 800 million from the Oman Investment Authority (OIA) remain a critical component of non-oil revenues, unchanged from the previous budget.

Looking ahead, the introduction of Oman’s Personal Income Tax (PIT) in 2028 is expected to provide a modest boost to revenue. As the first such tax in the Gulf Cooperation Council (GCC), PIT will target high-income earners at a flat rate of 5% on annual incomes exceeding RO 42,000 (approximately $109,000). S&P Global Ratings estimates that PIT could generate around RO 80 million in its first year, contributing roughly 0.1% to GDP and supplementing existing tax revenues, which currently constitute about 14% of total government income.

Fiscal diversification remains essential to Oman’s economic sustainability strategy, evidenced by a robust growth in non-hydrocarbon revenues over the past five years. Revenues have surged from approximately RO 2.7 billion in 2020 to RO 3.507 billion in 2024—a near 30% increase—largely driven by higher VAT and excise tax collections, corporate taxes, and non-tax income from dividends and service charges.

For the fiscal year 2025, non-hydrocarbon revenues are estimated at approximately RO 3.573 billion. This includes RO 680 million from VAT and excise taxes, RO 656 million from corporate income tax, RO 800 million in OIA-related dividends, and around RO 1.4 billion from various government fees.

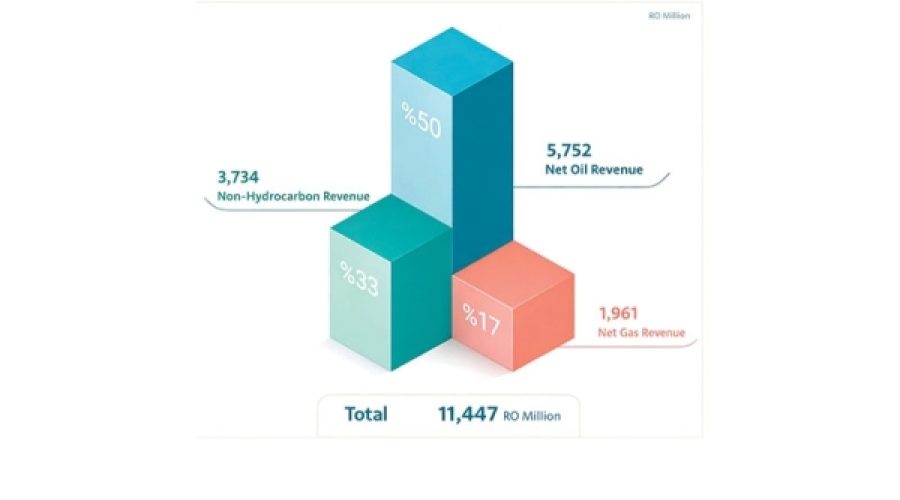

Despite these advancements, hydrocarbon revenues continue to dominate Oman’s fiscal landscape. For FY 2026, oil and gas revenues are projected to comprise 67% of total government revenues, which are budgeted at RO 7.7 billion, reflecting a 1.4% increase from the RO 7.6 billion budgeted for 2025.

According to KPMG, the projected hydrocarbon revenues of RO 7.7 billion for 2026 represent a 5.8% decline from the preliminary figure of RO 8.2 billion in 2025, attributed to lower realized oil prices and production costs associated with Energy Development Oman and other producers. Oil revenues are expected to reach RO 5.7 billion, marking a 10.2% decline from the previous year’s preliminary figure of RO 6.4 billion, based on a more conservative average oil price assumption of $60 per barrel, down from $70 in 2025.

Conversely, gas revenues are budgeted at RO 1.9 billion, a 10.4% increase over the previous year’s estimate of RO 1.7 billion, fueled by the signing of 17 new gas sales agreements and annual price increases. Compared to the prior year’s preliminary total of RO 1.8 billion, gas revenues are projected toincrease by approximately 10%.

Special Analysis by Omanet | Navigate Oman’s Market

Oman’s continued diversification of non-hydrocarbon revenues presents significant opportunities for businesses, particularly in sectors benefiting from increased VAT and excise taxes, alongside a rising corporate income tax base. However, the reliance on oil revenues—projected to remain at 67% of total revenues—poses a risk, especially as global prices fluctuate. Smart investors should consider strategizing towards sectors like renewable energy and digital services that align with the government’s fiscal sustainability goals while staying agile to adapt to potential regulatory changes with the introduction of a Personal Income Tax.