Duqm Energy Logistics Hub Expansion: What Sumitomo-EDO Joint Venture Means for Business Opportunities in Oman

MUSCAT – Duqm’s emergence as a key regional energy logistics hub was further cemented on Monday, October 27, 2025, with the signing of a joint venture to create Oman’s first integrated energy supply chain management company within the Special Economic Zone (SEZ).

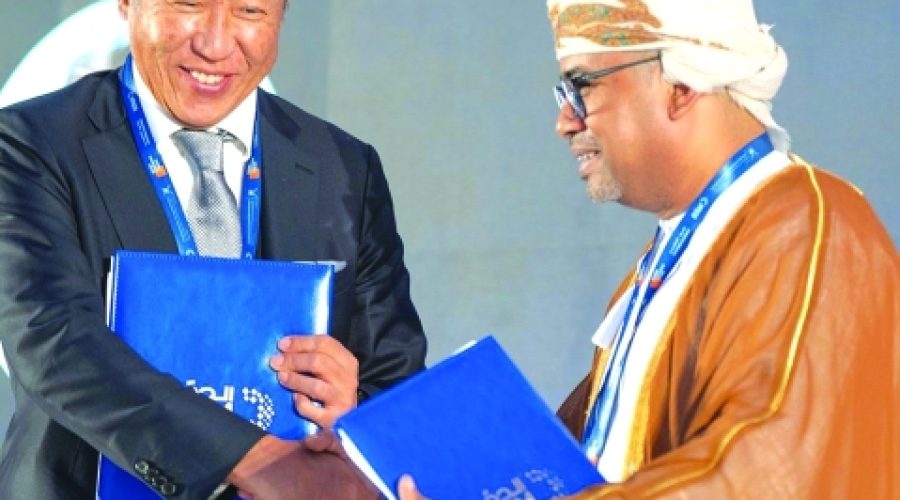

The joint venture partners are Energy Development Oman (EDO), a wholly Omani state-owned energy holding company, and the Middle East division of the Japanese trading and investment conglomerate Sumitomo Corporation. The agreement was signed on the opening day of the Duqm Economic Forum 2025, held in the SEZ.

Mazin al Lamki, Managing Director of EDO, and Masahiro Yoshimura, General Manager of Sumitomo Corporation, signed the agreement on behalf of their respective organisations.

EDO highlighted that this strategic partnership represents a crucial advancement in strengthening Oman’s national energy ecosystem, focusing on local content development, enhancing industrial value chains, and nurturing Omani talent, while also positioning Duqm as a vital logistics and energy industry hub.

“Located at the strategic crossroads of Asia, Africa, and the Middle East, this partnership will transform supply chains from mere support functions into key drivers of economic growth by linking investment, industry, and innovation within an integrated framework,” EDO stated.

Sumitomo explained that the integrated supply chain management will enable them to efficiently coordinate the procurement, storage, and just-in-time delivery of Oil Country Tubular Goods (OCTG) to Oman’s oil and gas fields, minimizing downtime. Centralising logistics through Duqm allows Sumitomo to provide cost-effective, reliable, and locally supported access to critical well-construction materials.

Sumitomo Corporation Middle East (SCME) has been a long-standing OCTG supplier to Petroleum Development Oman (PDO). EDO, holding 60% ownership of oil resources and full ownership of non-associated gas resources in Block 6 operated by PDO, is Oman’s largest OCTG consumer.

The supply of tubular products began in 2003 when Sumitomo Corporation, alongside Nippon Steel & Sumitomo Metal Corporation (NSSMC), entered agreements to supply high-quality tubular goods to PDO, the Sultanate’s largest hydrocarbon producer.

A dedicated storage facility for OCTG has been established in the Port of Duqm’s logistics zone as part of a ‘Mill to Well’ model, aimed at optimizing supply chain efficiencies for delivering these pipes to PDO.

In remarks to Oman Observer, Sumitomo’s Yoshimura described the partnership as a landmark in enhancing the supply chain for tubular steel products, which are essential for sustaining hydrocarbon operations in Oman.

“Over 20 years ago, I was involved in launching inventory operations for PDO with Sumitomo Corporation,” Yoshimura recalled. “Initially based in Dubai due to the absence of free zones in Oman, we later moved to SOHAR Port and Freezone before finally establishing ourselves here in Duqm. We are proud to contribute to Oman’s growth once again, this time alongside EDO.”

The Duqm hub will offer more than storage services; it will utilise advanced software to manage inventory efficiently, preventing unnecessary stockpiling and waste.

“Our contribution is operational and technical expertise. Together with EDO, we aim to build a world-class, highly efficient supply chain model in Oman,” Yoshimura emphasized.

While primarily serving Oman’s energy sector, Sumitomo also intends to explore opportunities with EDO to expand the partnership’s scope to include support for solar and wind energy equipment, broadening the hub’s role in Oman’s renewable energy future.

Special Analysis by Omanet | Navigate Oman’s Market

The establishment of Oman’s first integrated energy supply chain management company in Duqm, through a strategic JV between EDO and Sumitomo Corporation, positions Duqm as a pivotal logistics and energy hub at a global crossroads. For businesses, this enhances opportunities in supply chain innovation, industrial value addition, and local talent development, while smart investors should eye expansion beyond hydrocarbons into renewable energy logistics as the partnership hints at future diversification. This move also mitigates risks tied to supply disruptions in oil and gas projects by ensuring just-in-time delivery efficiency backed by advanced inventory management.