UK Economy Returns to Growth: What the Rebound in Car Manufacturing Means for Investors and Entrepreneurs in Oman

LONDON: The UK economy returned to growth in November, driven by a strong rebound in car manufacturing following Jaguar Land Rover’s resumption of production after a major cyberattack, according to official data.

The Office for National Statistics (ONS) reported that gross domestic product (GDP) rose by 0.3% in November, reversing a revised 0.1% decline in October. This increase exceeded economists’ expectations, which had forecast a 0.2% rise.

Revisions to earlier data also revealed that the economy expanded by 0.1% in September, overturning a previous estimate of contraction. This adjustment was partly due to updated figures from the pharmaceutical industry.

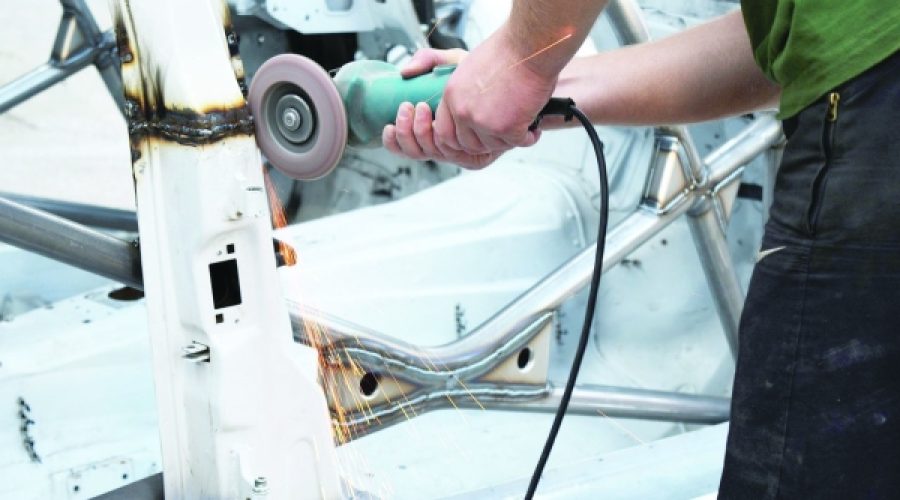

The significant growth in November was largely attributed to a 25.5% surge in motor vehicle manufacturing, as the sector recovered from a sharp drop in September when Jaguar Land Rover temporarily halted operations at production and sales sites following the cyberattack. By November, production had returned to near-normal levels.

Liz McKeown, director of economic statistics at the ONS, noted that the motor manufacturing sector had “largely recovered.” However, she highlighted that the construction industry continued to contract, experiencing its steepest three-month decline in nearly three years.

Construction output fell 1.3% in November, extending a recent downward trend. In contrast, the overall production sector increased by 1.1%, supported by the motor manufacturing recovery and a 3.8% rise in pharmaceutical production.

The services sector also grew by 0.3%, rebounding from a 0.3% fall in October. This improvement was partly driven by a 1.7% increase in professional and scientific services.

The stronger-than-expected growth data comes despite widespread business caution ahead of the autumn budget, providing a welcome boost to Chancellor Rachel Reeves after a period of sluggish economic performance.

Ben Jones, lead economist at the Confederation of British Industry, commented that the figures suggest the economy was more resilient late last year than previously thought, although investment is likely to remain weak due to subdued demand, high costs, and supply constraints.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, cautioned that the return to growth is unlikely to signal a sustained recovery, pointing to weakening consumer spending and rising unemployment pressures as the country heads into 2026. — dpa

Special Analysis by Omanet | Navigate Oman’s Market

The UK’s unexpected GDP growth in November, driven mainly by a rebound in motor vehicle manufacturing and pharmaceuticals, signals resilience in key industrial sectors despite broader economic challenges. For Omani businesses, this suggests opportunities in automotive and pharma supply chain partnerships or technology transfer, while investors should cautiously monitor the UK’s uneven sector recovery and potential headwinds in consumer demand. Smart entrepreneurs must consider diversifying markets and hedging against volatility as the UK economy faces uncertain growth prospects in 2026.