CBO Survey Reveals Prudent Financial Habits Among Omanis: What This Means for Investors and Businesses in Oman

By Conrad Prabhu

Muscat, September 26

Despite a gradual rise in personal and household debt in Oman, significant portions of the population continue to demonstrate commendable prudence in managing their finances, according to a recent national survey conducted by the Central Bank of Oman (CBO).

The survey, part of the CBO’s ongoing initiative to enhance financial literacy, assessed public awareness, attitudes, and behaviors related to financial planning, saving, spending, and investing. The findings provide valuable insights into the current financial culture in Oman, as detailed in the Central Bank’s newly released Financial Stability Report 2025.

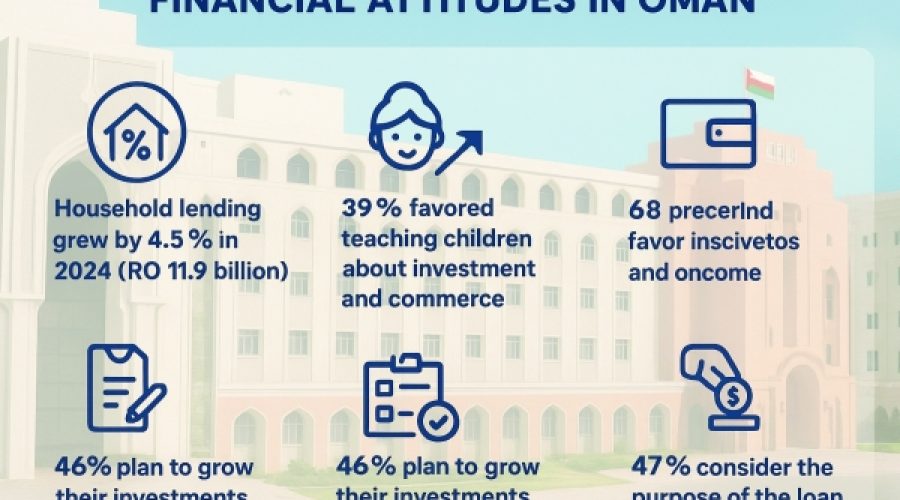

Household lending in Oman increased by 4.5 percent in 2024, reaching RO 11.9 billion and accounting for 36.9 percent of total bank lending. This marks a slight decline from 4.8 percent growth in 2023 but remains higher than the 2.8 percent recorded in 2022. Household debt relative to non-oil GDP rose to 42.6 percent in 2024 from 41.1 percent the previous year, maintaining consistency with historical annual averages.

A particularly noteworthy finding from the survey is strong public support for early financial education. Approximately 39 percent of respondents advocate teaching children about investment and commerce, while 36 percent support providing weekly allowances to encourage budgeting and responsible spending. Other approaches include opening savings accounts for children or offering money only as needed. These preferences highlight a widespread interest in preparing young people for real-world financial responsibilities through practical learning.

The survey also found that 67 percent of participants strongly agree that a higher income improves financial security, with another 23 percent somewhat agreeing. However, income alone is viewed as insufficient without effective budgeting and financial planning. Despite this, only 58 percent of respondents have a financial emergency plan in place, while 32 percent do not and 10 percent have never considered one, underscoring the need for greater awareness around financial resilience.

Financial priorities for the year varied among respondents: 46 percent aim to grow their investments, 30 percent plan to reduce debt, and 24 percent hope to purchase property. Borrowing decisions appear carefully considered, with 47 percent prioritizing the loan’s purpose over factors such as interest rates or loan duration, indicating a responsible attitude toward debt.

When defining financial success, 45 percent cited achieving specific goals, 30 percent focused on increasing savings, and 25 percent emphasized debt reduction. Regarding extra income, 40 percent would split bonuses between debt repayment and investing, 37 percent would pay off debt entirely, and 23 percent would invest fully. Likewise, with an additional RO 10,000, 60 percent would allocate it between savings and business investment, demonstrating a balanced and cautious approach.

Savings behavior is mixed: 56.7 percent save regularly, but 25.9 percent do not, potentially increasing vulnerability during financial hardship. Budgeting remains a challenge, as 47.3 percent prepare monthly budgets while 23.1 percent do not budget at all. Spending is mostly tracked through SMS alerts (41.4 percent) or manually (22.5 percent), with only 14.2 percent using apps, presenting opportunities to promote digital financial tools.

Limited income remains a significant barrier for many, with a substantial number earning less than RO 1,000 monthly, restricting access to advanced financial products. Additionally, 45 percent rely on family members for advice on housing or personal loans, with minimal use of professional financial advisory services, indicating a need for wider financial literacy and advisory outreach.

In conclusion, the Central Bank highlighted encouraging signs of prudent financial behavior: nearly 40 percent of individuals consistently allocate income toward emergencies, an equal proportion focus on long-term financial goals, and 46.3 percent actively avoid borrowing beyond their means. These behaviors collectively reflect a cautious and forward-thinking approach to money management among Oman’s population.

Special Analysis by Omanet | Navigate Oman’s Market

The Central Bank of Oman’s survey highlights a cautious but growing financial awareness among households, presenting a dual opportunity for businesses to develop tailored financial products that promote responsible borrowing and savings behavior. For smart investors and entrepreneurs, the increasing focus on financial literacy and digital financial tools signals a timely niche for innovations in fintech and advisory services that cater to emerging market needs. However, the persistent income limitations and reliance on informal advice underscore risks linked to financial vulnerability that must be addressed through targeted education and inclusive financial solutions.