Oman’s Banking Assets Surge to RO 47.8 Billion: Implications for Investors and Business Growth

MUSCAT, NOV 5 – The Sultanate of Oman’s banking sector is showcasing remarkable resilience and stability. Total assets are projected to reach RO 47.8 billion by 2025, a significant increase from RO 25.8 billion in 2015. These insights were shared at the Building a Future-Ready Bank summit organized by Cedar-IBS Intelligence.

The report reveals that Oman’s banking industry has experienced a compound annual growth rate (CAGR) of 6.1 percent over the past decade. This growth has been bolstered by prudent regulatory oversight and a consistent demand for credit.

Despite this impressive growth in assets, deposits have seen only modest increases, rising from RO 17.3 billion to RO 18.1 billion, resulting in a CAGR of merely 0.5 percent. Analysts attribute this to tight liquidity conditions, where banks face constrained deposit inflows yet maintain strong asset utilization.

Profitability within the sector has shown significant improvement as well. Net profits are expected to reach RO 620 million by 2025, up from RO 350 million in 2015, reflecting a CAGR of 6.5 percent. Operating income has surged from RO 920 million to RO 1.6 billion, while operating expenditure has grown from RO 420 million to RO 690 million, indicative of enhanced operational efficiency and stricter cost management.

The report also highlighted the strong growth of Islamic banking, which now constitutes 19 percent of total banking assets—approximately RO 8.6 billion—in contrast to conventional banks, which hold 81 percent or RO 39.2 billion. This growth represents a significant milestone for Sharia-compliant finance in Oman, with increasing product innovation and customer acceptance.

Experts at the summit emphasized that Oman’s banking sector reflects sustained growth momentum and balance sheet expansion, while the moderation in deposit levels indicates tightening liquidity alongside efficient asset management.

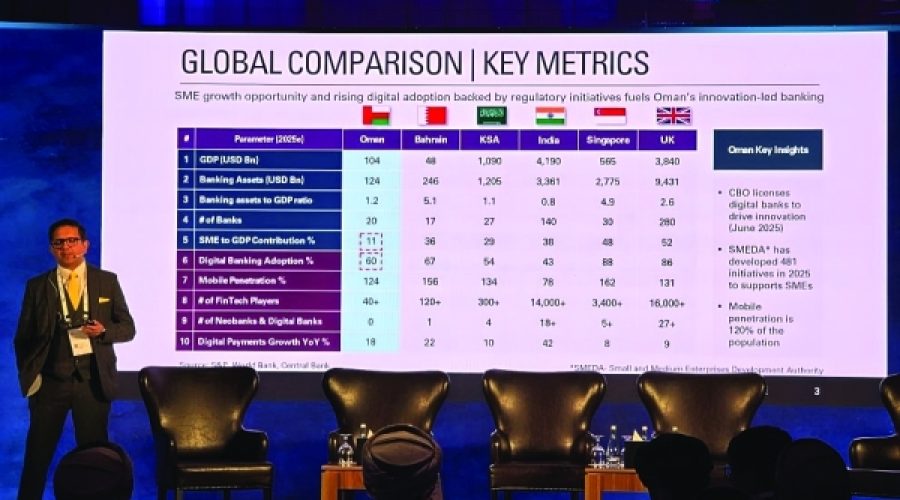

The Central Bank of Oman (CBO) continues to play a pivotal role through conservative monetary policies and targeted financial reforms. These include initiatives for digital bank licensing and fintech acceleration, aimed at ensuring financial stability while fostering innovation in alignment with Oman Vision 2040.

Industry representatives noted that as banks increasingly embrace digital transformation, the emphasis is shifting towards data-driven growth, AI-enhanced decision-making, and a customer-centric approach. One participant remarked, “The next decade will focus on quality rather than just quantity — Oman’s banks are already positioning themselves for this transition.”

Overall, the data suggest a banking system that is financially sound, technologically adaptive, and increasingly diverse—well-equipped to support Oman’s long-term economic goals even amid tight liquidity conditions.

Special Analysis by Omanet | Navigate Oman’s Market

The Oman banking sector’s projected growth to RO 47.8 billion by 2025 signals significant opportunities for businesses, especially in fintech and Islamic banking, given their increasing relevance in the market. However, the tight liquidity conditions suggest a risk for startups relying on traditional financing; thus, investors should pivot toward innovative financial solutions and digital strategies. Adapting to this evolving landscape could position entrepreneurs to gain a competitive advantage as the sector emphasizes quality growth over mere volume.