Oman Real Estate Market Stability: Key Insights for Investors and Entrepreneurs

MUSCAT, AUG 26 — The real estate market in the Sultanate of Oman has shown notable resilience during the first half of 2025, maintaining momentum across key sectors despite ongoing global economic uncertainty, as reported by Hamptons in their H1 2025 Market Report. The market’s stability is largely attributed to sustained infrastructure investments, reforms aligned with Oman Vision 2040, and a commitment to sustainability goals.

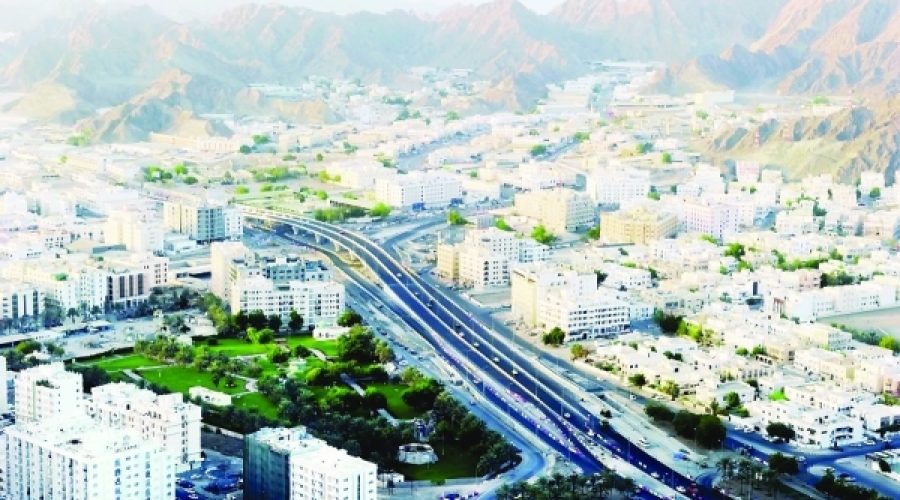

Key real estate hubs identified in the report include Muscat, Al Duqm, Suhar, and Salalah, each representing unique economic strengths. Muscat has maintained its status as the most dynamic market, supported by government initiatives in urban development and rising demand for high-end residential and office properties.

Al Duqm is establishing itself as a center for industrial and logistics investments, while Suhar continues to see strong demand for warehousing. Conversely, Salalah is benefitting from a gradual revival in tourism-related real estate.

ECONOMIC BACKDROP

Oman’s economy witnessed a growth of 2.3% in the first half of 2025, driven by enhancements in logistics, manufacturing, and tourism. Non-oil GDP now comprises over 35% of national output, reflecting the country’s diversification efforts. Inflation has remained stable at 1.8%, and employment metrics have improved due to increased private-sector activities in burgeoning industries.

The price of Brent crude averaged $62 per barrel during this period, contributing to fiscal stability. Analysts caution, however, that Oman’s measured strategy to reduce dependence on hydrocarbons is essential for sustaining investor confidence.

OFFICE MARKET

The office market in Muscat remained favorable for tenants, although demand for Grade A space increased, with absorption rates rising by 7% year-on-year. Premium locations such as Al Mouj and Madinat Al Irfan achieved rents of RO 12 and RO 7 per square meter per month, respectively, compared to RO 5 in secondary areas like Al Khuwair and Al Ghubra.

There is a rising interest in ESG-certified office buildings, particularly among multinational and financial tenants pursuing sustainable office solutions.

RETAIL SECTOR

Retail performance stabilized in the first half of 2025, especially in popular centers like the Mall of Oman and The Avenues Mall, which reported high occupancy rates. The sector is experiencing a shift towards food and beverage offerings and experiential retail, with landlords increasingly implementing hybrid leasing models that include turnover-based rent structures.

RESIDENTIAL MARKET

The residential sector maintained robust demand for mid-income apartments and villas, with rental prices in high-end districts like Al Mouj and Al Qurum gradually increasing. Gated communities managed by professionals commanded 10-15% rental premiums over standalone properties.

Affordable housing initiatives aligned with Oman Vision 2040 have gained traction, while demand for smart residential buildings with enhanced amenities continues to rise.

INDUSTRIAL AND LOGISTICS

The logistics and warehousing sectors have emerged as some of the strongest performers, with significant demand in Suhar, Al Duqm, and Al Rusayl. SOHAR Port and Freezone remain the most active investment hubs, drawing tenants in light manufacturing and food processing.

In Al Duqm, there has been increased interest from Chinese and Indian logistics firms, reflecting changing supply chain dynamics between the GCC and Asia. The report also indicates a growing investor preference for green warehouses and ESG-compliant industrial assets.

HOSPITALITY AND TOURISM

In Muscat, hotel occupancy rates averaged 59% during the first half of 2025, bolstered by a rebound in business travel and regional tourism. Boutique hotels and eco-resorts in Dhofar and Al Jabal Al Akhdhar reported strong occupancy, in line with Oman’s emphasis on sustainable tourism.

Visitor arrivals increased by 2.3% year-on-year in Q1, alongside a notable 10.6% rise in hotel revenues. Average daily rates in the four- and five-star segments rose by 7%, with bullish performance anticipated during the Khareef Dhofar Season in the second half of 2025.

OUTLOOK

Going forward, Hamptons projects that Oman’s real estate sector will experience steady growth in the second half of 2025, driven by industrial demand, affordable housing initiatives, advancements in digital infrastructure, and ESG integration. The residential market is expected to grow at a compound annual rate of 9.19%, increasing from $4.75 billion in 2024 to $6.6 billion by 2029.

Special Analysis by Omanet | Navigate Oman’s Market

The Omani real estate market is poised for growth, driven by infrastructure investments and a focus on sustainability, presenting significant opportunities for investors in sectors like logistics and affordable housing. However, risks remain, particularly as the economy pivots away from hydrocarbon reliance, which necessitates careful consideration of market dynamics for long-term success. Smart investors should prioritize ESG-compliant projects and adapt to evolving demands in urban development to capitalize on emerging trends.